The Exness Economic Calendar is a powerful tool for traders who want to stay updated on important economic events that can impact the financial markets. By understanding how to use this calendar effectively, traders can optimize their trading strategies, anticipate market volatility, and make more informed trading decisions.

What is the Economic Calendar?

The Economic Calendar provides a schedule of upcoming economic events, including data releases, central bank announcements, and other significant reports that may influence the Forex, commodities, indices, and cryptocurrency markets.

| Feature | Description | How It Benefits Traders | Example of Use |

| Real-Time Data | Provides instant updates on economic releases | Allows traders to react swiftly to market changes | Reacting to Non-Farm Payrolls (NFP) data |

| Impact Level Indicators | Categorizes events into low, medium, and high impact | Helps prioritize which events to monitor | Focusing on central bank rate decisions |

| Customizable Filters | Filter by date, country, impact level, and asset type | Tailors the calendar to individual trading preferences | Filtering for high-impact events affecting EUR/USD |

| Historical Data Access | View past economic data to analyze trends | Useful for backtesting trading strategies | Reviewing past GDP growth data for EU |

| Notifications & Alerts | Set alerts for specific events to stay informed | Prevents missing crucial announcements | Setting alerts for Fed interest rate announcements |

| Forecast vs. Actual Comparison | Shows analyst predictions alongside released figures | Helps in assessing the market’s reaction to unexpected results | Comparing forecasted CPI with actual release |

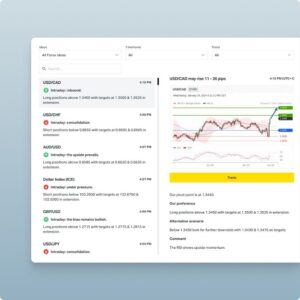

Step-by-Step Guide to Using the Exness Economic Calendar

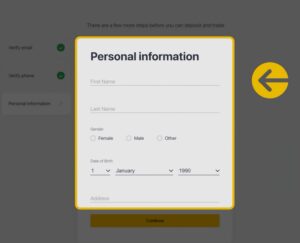

- Log in to Your Exness Account

- Visit Exness and log in with your credentials.

- Access the Economic Calendar

- Navigate to the “Tools” section and select “Economic Calendar.”

- Customize Filters

- Use the filters to adjust the view based on date, country, and impact level.

- Select the asset class (e.g., Forex, commodities) you are interested in.

- Review Upcoming Events

- Focus on high-impact events like central bank interest rate decisions or GDP reports.

- Plan Your Trades

- Analyze the forecasted values against previous data to anticipate market reactions.

Detailed Examples of Key Economic Indicators

Economic indicators provide insights into a country’s economic health and can cause significant market reactions. Let’s look at some key indicators and how they affect trading:

| Indicator | Country | Impact Level | Description | Frequency | Relevance for Traders | Example of Market Impact |

| Gross Domestic Product (GDP) | U.S., EU | High | Measures the total economic output of a country | Quarterly | Indicates overall economic health | Positive GDP growth can strengthen the USD |

| Interest Rate Decisions | All major economies | High | Determines the cost of borrowing | Monthly/Quarterly | Major impact on currency strength | A rate hike by the Fed can boost the USD |

| Unemployment Rate | U.S., EU, UK | Medium | Shows the percentage of unemployed workers | Monthly | Impacts consumer spending and sentiment | Higher unemployment can weaken a currency |

| Consumer Price Index (CPI) | Japan, EU | Medium | Measures inflation by tracking changes in prices | Monthly | Key indicator for central bank policies | Rising CPI may lead to rate hikes |

| Retail Sales | U.S., UK | Medium | Tracks consumer spending trends | Monthly | Affects retail stocks and indices | Strong retail sales boost equity markets |

| Industrial Production | Germany, China | Low | Measures output in the industrial sector | Monthly | Relevant for commodities and manufacturing | Drop in production can hurt commodity prices |

| Non-Farm Payrolls (NFP) | U.S. | High | Measures job creation excluding the agricultural sector | Monthly | Indicates economic health and consumer spending | Positive NFP can lead to USD rally |

Explanation: High-impact events, like central bank decisions and GDP reports, often lead to increased market volatility, making them key events to monitor for trading opportunities.

Expanded Breakdown of Impact Levels on Market Volatility

| Event Type | Impact Level | Typical Market Reaction | Examples | Suggested Strategy |

| Central Bank Meetings | High | Large swings in currency pairs, indices, and commodities | ECB and Fed rate decisions | Use tight stop-losses due to high volatility |

| GDP Announcements | High | Sharp movements in national currencies and stock indices | U.S. GDP releases | Look for breakout opportunities |

| Inflation Reports (CPI, PPI) | Medium | Moderate effect on currency strength | EU CPI data | Focus on swing trades based on inflation trends |

| Employment Reports | High | Major influence on stock indices and Forex pairs | U.S. Non-Farm Payrolls, UK unemployment rates | Scalping strategies with tight risk management |

| Retail Sales Data | Medium | Affects stock indices and consumer-driven sectors | U.S. and China retail sales | Long-term trades on consumer goods stocks |

| Consumer Confidence | Low | Minor impact on equity markets | U.S. Consumer Confidence Index | Position trading based on economic outlook |

| Manufacturing PMI | Medium | Influences industrial stocks and commodities | China Manufacturing PMI | Focus on commodities like copper and steel |

How to Analyze Forecasts vs. Actual Data

When using the economic calendar, it’s essential to compare the forecasted figures with the actual released data to understand market reactions. Here’s a breakdown of how to interpret these numbers:

| Column | Description | How to Use It for Trading | Example |

| Date & Time | Indicates when the economic event is scheduled | Plan trades to avoid entering right before announcements | Avoid trading before NFP data release |

| Country | Shows which country’s data is being released | Focus on relevant currencies and assets | GBP/USD for UK data releases |

| Event | Name of the economic indicator | Determine whether it aligns with your trading strategy | CPI data relevant for inflation-focused strategies |

| Forecast | Analyst predictions for the event | Compare with previous data to gauge market expectations | Positive forecast for GDP growth may strengthen a currency |

| Actual | The released figure | Surprises (positive or negative) can lead to volatility | Higher-than-expected CPI can lead to rate hikes |

| Previous | Value from the last report | Helps to understand trends and market reactions | Use historical data for technical analysis |

Expanded Best Practices for Using the Economic Calendar

| Tip | Description | Why It Matters | Example |

| Set Alerts for High-Impact Events | Receive notifications before major events occur | Prevents missing out on important market-moving news | Set alerts for Fed rate decisions |

| Avoid Trading During High Volatility | Reduce risk by staying out of the market during announcements | Protects against sudden price swings | Close positions before Non-Farm Payrolls |

| Analyze Historical Data | Review past data to understand how markets react | Useful for predicting reactions to future releases | Study previous reactions to ECB rate changes |

| Use Stop-Loss Orders | Protect positions from large, unexpected moves | Prevents significant losses during volatile periods | Tight stop-loss before central bank announcements |

| Focus on Key Indicators by Country | Different economies are influenced by different indicators | Improves targeting of currency pairs | Focus on JPY pairs during Bank of Japan statements |

| Diversify Based on Economic Reports | Trade across multiple asset classes to spread risk | Reduces impact of volatility in a single market | Trade both Forex and commodities around data releases |

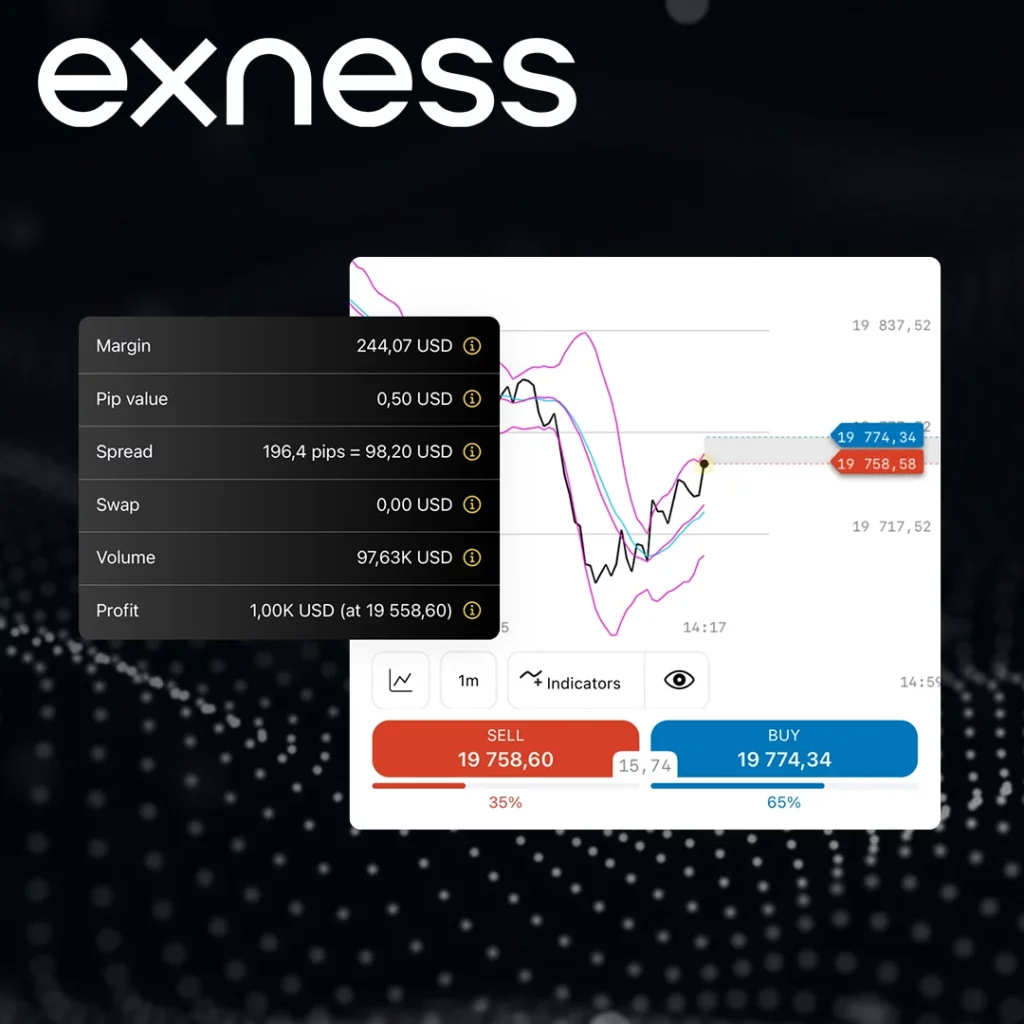

Expanded Comparison of Trading Strategies Based on Economic Events

| Strategy | Best for Event Type | Description | Execution Tips | Risk Level |

| Breakout Trading | High-impact news | Capitalize on sharp price movements immediately after announcements | Use pending orders above and below support/resistance levels | High |

| Mean Reversion | Medium-impact events | Trade reversals after market overreacts to moderate news | Wait for price to return to average levels before entering | Medium |

| Scalping | High volatility periods | Focus on small, quick profits during market turbulence | Use tight stop-loss and take-profit levels | Very High |

| Swing Trading | Medium to low impact | Take advantage of price swings based on macroeconomic data | Enter trades after confirming trends with technical analysis | Medium-Low |

| Position Trading | Low-impact news | Focus on long-term trends, ignoring short-term noise | Use fundamental analysis to align with economic cycles | Low |

Example of Trading Strategies Based on the Economic Calendar

| Strategy | Event Type | Description | Expected Outcome |

| Breakout Trading | High-impact news | Enter trades immediately after significant announcements | Capitalize on strong market moves |

| Mean Reversion | Medium-impact events | Wait for the market to overreact, then trade reversals | Profitable in overextended markets |

| Scalping | High volatility periods | Use tight stop-loss and take-profit levels | Quick profits in volatile markets |

| Long-Term Positions | Low-impact news | Ignore short-term noise and focus on fundamentals | Ideal for swing and position traders |

Conclusion

Using the Exness Economic Calendar effectively can significantly enhance your trading strategy. By staying informed about upcoming events and understanding how they impact the market, you can make better trading decisions. Use the calendar, filters, and alerts to stay ahead of the market and optimize your trading performance.

Trade with a trusted broker Exness today

See for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

Frequently Asked Questions (FAQs)

Is the Economic Calendar free to use?

Yes, Exness provides it for free to all registered users.