The Exness Social Trading Platform offers an innovative way for traders to follow and copy the strategies of experienced traders. By leveraging the knowledge of top traders, beginners can benefit from their expertise without having to analyze the markets themselves. In this guide, we’ll explore how Exness Social Trading works, its benefits, and practical tips for using the platform effectively.

What is Exness Social Trading?

Social trading on Exness allows users to copy the trades of experienced traders (also known as strategy providers) automatically. It’s a convenient way for less experienced traders to engage in the markets while learning from experts.

| Term | Definition |

| Social Trading | Copying trades from experienced traders directly into your account |

| Strategy Provider | An experienced trader who shares their trading strategies |

| Copy Trader | A user who copies trades from strategy providers |

| Profit Share | The percentage of profit paid to the strategy provider |

| Risk Level | Indicates the level of risk associated with a strategy |

| Drawdown | The maximum drop from the peak in the account balance |

Key Features of Exness Social Trading Platform

Exness Social Trading is designed to be user-friendly, offering a range of features that benefit both novice and experienced traders. Here’s a breakdown of some of its key features:

| Feature | Description | Benefit for Users | Example of Use |

| Real-Time Copying | Trades are copied instantly from strategy providers to followers | Ensures accurate trade replication | Following a top-performing trader during market volatility |

| Profit Sharing | Strategy providers earn a share of the profits from their followers | Incentivizes experts to share successful strategies | A provider charges a 20% profit share on earnings |

| Customizable Risk Levels | Adjust the risk level to match your trading preferences | Allows users to control their exposure | Reducing risk by copying trades at a lower ratio |

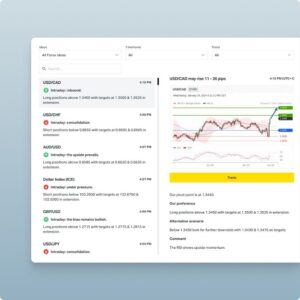

| Detailed Performance Metrics | Provides stats on provider performance, risk, and drawdown | Helps users make informed choices | Checking historical performance before copying |

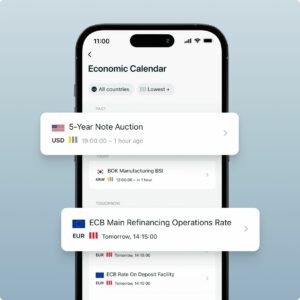

| Mobile Access | Available on iOS and Android apps | Trade on the go with full platform functionality | Monitoring copied trades while traveling |

These features make social trading an attractive option for those looking to enter the markets with minimal effort. By following strategy providers with proven track records, you can potentially enhance your returns while keeping risk levels under control.

Step-by-Step Guide to Using Exness Social Trading

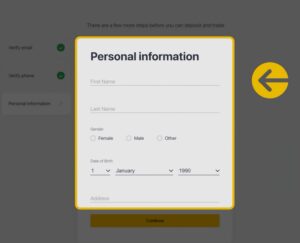

- Sign Up for an Exness Account

- Visit Exness and register for a trading account.

- Access the Social Trading Platform

- Log in and navigate to the “Social Trading” section.

- Choose a Strategy Provider

- Browse through the list of strategy providers based on their performance, risk level, and profit share.

- Evaluate Performance Metrics

- Check the historical returns, drawdown, and risk level before selecting a strategy provider.

- Allocate Funds and Set Risk Levels

- Choose how much capital to allocate and adjust the risk settings according to your risk tolerance.

- Monitor and Adjust

- Regularly review your copied trades and adjust your strategy as needed.

Comparison of Exness Social Trading with Competitors

| Feature | Exness Social Trading | eToro | ZuluTrade |

| Minimum Deposit | $500 | $200 | $300 |

| Profit Share Model | Yes (15%-30%) | No (spreads and commissions) | Yes (up to 20%) |

| Platform Fee | None | 1% withdrawal fee | Varies by broker |

| Average Copying Latency | Less than 1 second | 1-3 seconds | 2-5 seconds |

| Mobile Access | iOS, Android | iOS, Android | iOS, Android |

| Risk Management Tools | Adjustable risk levels | Fixed allocation | Adjustable stop levels |

| Number of Strategy Providers | 100+ | 10,000+ | 5,000+ |

| Account Verification | Required for all users | Required for withdrawals | Required |

| Assets Available | Forex, Cryptos, Commodities, Indices | Stocks, Forex, Cryptos | Forex, Cryptos, Commodities |

Explanation:

- Exness Social Trading offers lower copying latency and a profit-sharing model that incentivizes strategy providers to deliver better results.

- eToro is more focused on stocks and equities, making it a better choice for traders interested in diversified stock portfolios.

- ZuluTrade provides a wide range of Forex strategies with customizable risk management tools but may have higher platform fees depending on the broker used.

Best Practices for Choosing a Strategy Provider

| Tip | Why It’s Important | Example |

| Review Historical Performance | Helps assess consistency in returns and risk management | Selecting providers with steady growth over time |

| Check the Drawdown | Indicates the maximum loss a provider experienced | Avoid providers with excessive drawdowns |

| Diversify Across Multiple Providers | Reduces risk by spreading your investment across strategies | Copying trades from 3-5 different providers |

| Adjust Risk Levels | Allows you to control your exposure to market volatility | Setting a lower risk ratio for new providers |

| Monitor Regularly | Ensures your strategy aligns with changing market conditions | Checking performance weekly |

Expanded Breakdown of Social Trading Metrics

| Metric | Description | How It Affects Copy Trading |

| Profit Share | Percentage of profits paid to the strategy provider | Higher profit shares may reduce net earnings |

| Risk Level | Indicates how aggressive a trading strategy is | High-risk strategies can lead to higher drawdowns |

| Average Trade Duration | The average time trades are held | Longer durations may be better for swing trading |

| Win Rate | Percentage of profitable trades made | A high win rate doesn’t always mean higher returns |

| Followers’ Capital | Total funds allocated by followers | Higher capital suggests provider’s reliability |

How to Evaluate and Manage Risks in Social Trading

| Risk Factor | Description | Suggested Action |

| High Drawdown | Indicates that the provider has experienced significant losses | Choose providers with lower historical drawdown |

| Inconsistent Returns | Unstable monthly returns may indicate poor risk management | Diversify across multiple providers |

| High Profit Share | Providers with high profit shares take a larger cut of your earnings | Opt for providers with reasonable profit share rates |

| Short Account Age | Newer providers may not have proven their strategies in different market conditions | Focus on accounts with at least 12 months of history |

| Low Number of Trades | Providers with fewer trades may not be active enough to deliver consistent results | Consider providers with a higher trading frequency |

Conclusion

The Exness Social Trading Platform is a powerful tool for traders who want to leverage the expertise of seasoned professionals. By carefully selecting strategy providers and managing your risk, you can maximize your potential returns while minimizing exposure to market volatility. Use the tips and tables provided in this guide to make informed decisions and optimize your social trading experience.

Trade with a trusted broker Exness today

See for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

Frequently Asked Questions (FAQs)

Is Exness Social Trading free to use?

Yes, but strategy providers take a share of the profits (profit share).