Exness provides traders with access to valuable trading signals, helping them make informed decisions. These signals are generated using technical analysis, market trends, and historical data, giving traders an edge in their trading journey. This article explains how to access, interpret, and use Exness trading signals effectively.

What Are Trading Signals?

Trading signals are alerts or suggestions provided to traders, indicating potential trading opportunities. They can include:

- Entry and exit points for trades.

- Stop-loss and take-profit levels.

- Market trends and patterns.

- Possible price movements.

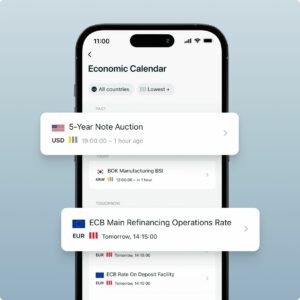

How to Access Exness Trading Signals

To make use of Exness trading signals, you need to follow these simple steps:

- Log in to your Exness account: If you don’t have an account, register on the Exness website.

- Navigate to the ‘Tools’ section: Find the trading signals feature.

- Select the preferred instrument: Choose from Forex, commodities, indices, or cryptocurrencies.

- Analyze the signals: Review the provided data, such as entry prices, stop-loss, and target levels.

- Execute your trade: Use the signals to open or close positions on your chosen platform (MT4/MT5).

Key Components of Exness Trading Signals

| Component | Description |

| Signal Type | Can be buy or sell signals based on market conditions. |

| Entry Price | Suggested price to enter a trade. |

| Stop-Loss | The price level to limit potential losses. |

| Take-Profit | The target price to secure profits. |

| Time Frame | Indicates the validity period of the signal (e.g., 1 hour, daily). |

| Risk Level | Helps traders assess the potential risk involved. |

Types of Signals Provided by Exness

| Signal Type | Market | Details |

| Short-Term Signals | Forex, Cryptos | Useful for scalpers and day traders. |

| Mid-Term Signals | Commodities, Indices | Ideal for swing traders looking for steady returns. |

| Long-Term Signals | Stocks, Bonds | Focus on fundamental analysis for longer trades. |

Example of a Trading Signal from Exness

Here’s how a typical Exness trading signal might look:

| Parameter | Value |

| Instrument | EUR/USD |

| Signal Type | Buy |

| Entry Price | 1.1000 |

| Stop-Loss | 1.0950 |

| Take-Profit | 1.1050 |

| Time Frame | 4 Hours |

| Risk Level | Medium |

Step-by-Step Guide to Using Trading Signals

- Review the signal: Check the type of signal (buy or sell) and the recommended entry point.

- Assess your risk: Look at the stop-loss and take-profit levels to gauge the potential risk and reward.

- Adjust the trade size: Use appropriate lot sizes based on your risk tolerance.

- Open the trade: Enter the trade using the specified entry price.

- Monitor the position: Keep an eye on the market and adjust your stop-loss if necessary.

- Close the trade: Exit the position once the target is reached or if the market moves against you.

Comparing Exness Signals with Other Providers

| Feature | Exness | IG | Pepperstone |

| Accuracy | High | Medium | Variable |

| Signal Types | Forex, Commodities, Crypto | Forex only | Forex and Stocks |

| Real-Time Alerts | Yes | Yes | No |

| Platform Compatibility | MT4, MT5, Web Terminal | MT4 only | MT4, MT5 |

| Cost | Free for clients | Subscription-based | Free (limited access) |

Common Mistakes to Avoid When Using Trading Signals

- Ignoring Stop-Loss Levels: Always set a stop-loss to minimize potential losses.

- Overtrading: Don’t place too many trades based on every signal; focus on quality over quantity.

- Lack of Analysis: Use signals as a tool, but always conduct your own analysis before placing a trade.

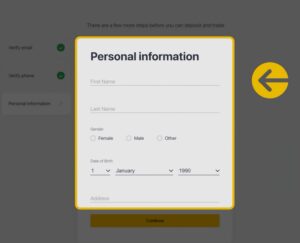

Trade with a trusted broker Exness today

See for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

Frequently Asked Questions (FAQs)

Are Exness trading signals free?

Yes, Exness provides trading signals free of charge to all its registered clients.