Exness is a leading broker in the forex industry, offering a variety of trading options to suit both beginners and advanced traders. This guide provides a detailed look at how forex trading works on Exness, with a focus on spreads, leverage, account types, and best practices. Let’s dive into everything you need to know about trading forex on Exness, using comprehensive tables to present key details.

Overview of Forex Trading on Exness

Forex trading on Exness provides traders with access to a wide range of currency pairs, competitive spreads, and flexible leverage options. Here’s a breakdown of the key features offered by Exness:

| Feature | Description | Benefit for Traders |

| Account Types | Standard, Pro, Zero, Raw Spread | Options for beginners and experienced traders |

| Leverage | Up to 1:2000 (depending on the account and region) | Maximizes trading potential with small capital |

| Spreads | From 0.0 pips (on Raw Spread Account) | Reduces trading costs, especially for scalpers |

| Trading Instruments | Over 100+ currency pairs, including majors, minors, and exotics | Diverse trading opportunities |

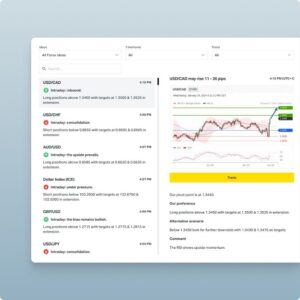

| Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), Exness WebTrader | Flexibility to trade on desktop, web, or mobile |

| Execution Speed | Less than 0.1 seconds | Quick execution to minimize slippage |

Breakdown of Exness Account Types

Exness offers various account types to meet the needs of different traders. The table below compares the key features of each account type:

| Account Type | Minimum Deposit | Spread (EUR/USD) | Commission per Lot | Leverage | Best For |

| Standard | $10 | From 1.0 pips | None | Up to 1:2000 | Beginners, low-frequency traders |

| Pro | $500 | From 0.1 pips | None | Up to 1:2000 | Experienced traders |

| Zero | $500 | 0.0 pips | $3.50 per lot | Up to 1:2000 | Scalpers, high-volume traders |

| Raw Spread | $500 | 0.0 pips | $3.50 per lot | Up to 1:2000 | Traders seeking the lowest spreads |

- Standard Account: Ideal for beginners due to its low deposit requirement and simple structure.

- Pro Account: Suitable for experienced traders who need access to tighter spreads without paying commissions.

- Zero Account: Best for scalpers due to zero spreads and low commissions.

- Raw Spread Account: Offers raw market spreads with a small commission, making it perfect for high-frequency traders.

Detailed Breakdown of Forex Spreads on Exness

Spreads vary by account type and currency pair. Below is a comparison of spreads for popular currency pairs on Exness:

| Currency Pair | Standard Account | Pro Account | Zero Account | Raw Spread Account |

| EUR/USD | From 1.0 pips | From 0.1 pips | 0.0 pips | 0.0 pips |

| GBP/USD | From 1.2 pips | From 0.2 pips | 0.1 pips | 0.1 pips |

| USD/JPY | From 1.0 pips | From 0.1 pips | 0.0 pips | 0.0 pips |

| AUD/USD | From 1.0 pips | From 0.2 pips | 0.1 pips | 0.0 pips |

| USD/CAD | From 1.5 pips | From 0.3 pips | 0.2 pips | 0.1 pips |

Leverage on Exness: Maximizing Trading Potential

Exness offers flexible leverage up to 1:2000, which can significantly enhance your trading potential. However, leverage also increases risk, so it’s essential to understand how it works.

| Leverage Level | Account Type | Best For | Example |

| Up to 1:2000 | Standard, Pro, Zero | High-risk traders, scalpers | $100 deposit can control $200,000 position |

| Up to 1:500 | Raw Spread | Medium-risk traders | $500 deposit controls $250,000 position |

| Up to 1:30 | EU Clients (regulated) | Retail traders | Complies with ESMA regulations |

| Up to 1:100 | Commodities, Indices | Low-risk, long-term traders | Lower risk exposure for non-Forex assets |

Note: Higher leverage can amplify both profits and losses. It’s recommended to use leverage wisely, especially if you’re new to trading.

Step-by-Step Guide to Start Forex Trading on Exness

If you’re new to forex trading on Exness, here’s a quick guide to get started:

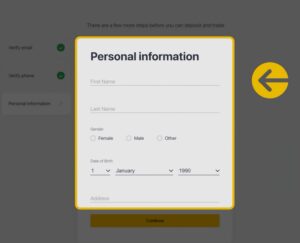

- Create an Exness Account

- Visit Exness and sign up for an account.

- Complete the account verification process.

- Choose the Right Account Type

- Select an account type based on your experience and trading goals (Standard, Pro, Zero, or Raw Spread).

- Deposit Funds

- Use one of the multiple deposit methods available, such as bank transfer, credit card, or e-wallet.

- The minimum deposit starts as low as $10.

- Download Trading Platform

- Download MetaTrader 4 (MT4), MetaTrader 5 (MT5), or use the Exness WebTrader.

- Start Trading

- Access a range of currency pairs, set your preferred leverage, and begin trading.

- Use stop-loss and take-profit orders to manage your risk.

Comparison of Exness Forex Trading with Other Brokers

Let’s compare Exness with other popular brokers like IG Markets and eToro to see how they stack up.

| Feature | Exness | IG Markets | eToro |

| Minimum Deposit | $10 | $300 | $200 |

| Spread (EUR/USD) | From 0.0 pips | From 0.6 pips | From 1.0 pips |

| Leverage | Up to 1:2000 | Up to 1:30 | Up to 1:400 |

| Trading Platforms | MT4, MT5, WebTrader | MT4, ProRealTime | Proprietary platform |

| Assets Available | Forex, Commodities, Crypto | Forex, Indices, Stocks | Stocks, ETFs, Crypto |

| Regulation | CySEC, FCA | FCA, ASIC | FCA, CySEC |

Insights:

- Exness provides higher leverage and lower spreads, ideal for high-frequency traders.

- IG Markets focuses on regulated markets, making it suitable for European traders.

- eToro is popular for social trading but has wider spreads compared to Exness.

Best Practices for Forex Trading on Exness

| Tip | Description | Example |

| Use Leverage Wisely | Higher leverage increases both potential profits and risks. | Start with lower leverage like 1:100 to control risk. |

| Set Stop-Loss Orders | Protect your capital by setting stop-loss levels. | Set a stop-loss at 1% of your account balance. |

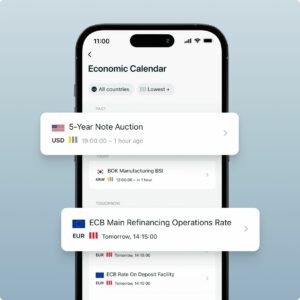

| Monitor Economic Events | Keep track of economic calendars for market-moving events. | Use Exness’s built-in economic calendar. |

| Diversify Your Trades | Trade multiple currency pairs to spread risk. | Mix major pairs like EUR/USD with exotics like USD/TRY. |

Trade with a trusted broker Exness today

See for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

Frequently Asked Questions (FAQs)

What is the minimum deposit to start trading on Exness?

The minimum deposit is $10 for the Standard Account.